Is your BNPL checkout costing you sales?

Any Buy Now Pay Later (BNPL) option at a checkout should boost sales, but that doesn’t mean all BNPL checkout processes are equally effective.

Buy Now Pay Later (BNPL) is commonly portrayed as a winning deal for everybody involved. Consumers get immediate access to goods and services via an interest-free loan. Retailers get to make sales they might otherwise miss out on. And BNPL shareholders get rich by acting as innovative fintech disruptors.

All of the above is true enough. But different BNPL businesses prioritise the interests of different stakeholders in different ways. And it’s easy for sales-hungry ecommerce businesses to overlook the inconvenient fact that the interests of BNPL businesses can diverge from the interests of merchants.

Especially when it comes to the checkout process.

Who’s benefiting from your checkout process?

To reiterate, having any BNPL payment option will likely increase a business’s sales in the short term, especially if its customers skew young. However, as is well-established, the more frictionless the checkout process, the less likely consumers will have time to grow impatient, rethink their purchase and abandon their cart.

One might assume tech-savvy BNPL businesses would make the checkout process as seamless as possible, but that is not how it usually works.

First, consumers typically have to apply for an account with a BNPL provider and get approved BEFORE they start shopping.

Second, when consumers want to use a BNPL option to make a purchase they are almost always redirected to the BNPL business’s site. This has several downsides for ecommerce businesses. The most obvious and important one is that it makes the checkout process clunkier.

This clunkiness persists because it has upsides for BNPL businesses. (They get an opportunity to promote themselves to consumers while collecting their eminently saleable data). Unfortunately for merchants, making the checkout process more drawn out substantially increases cart abandonment.

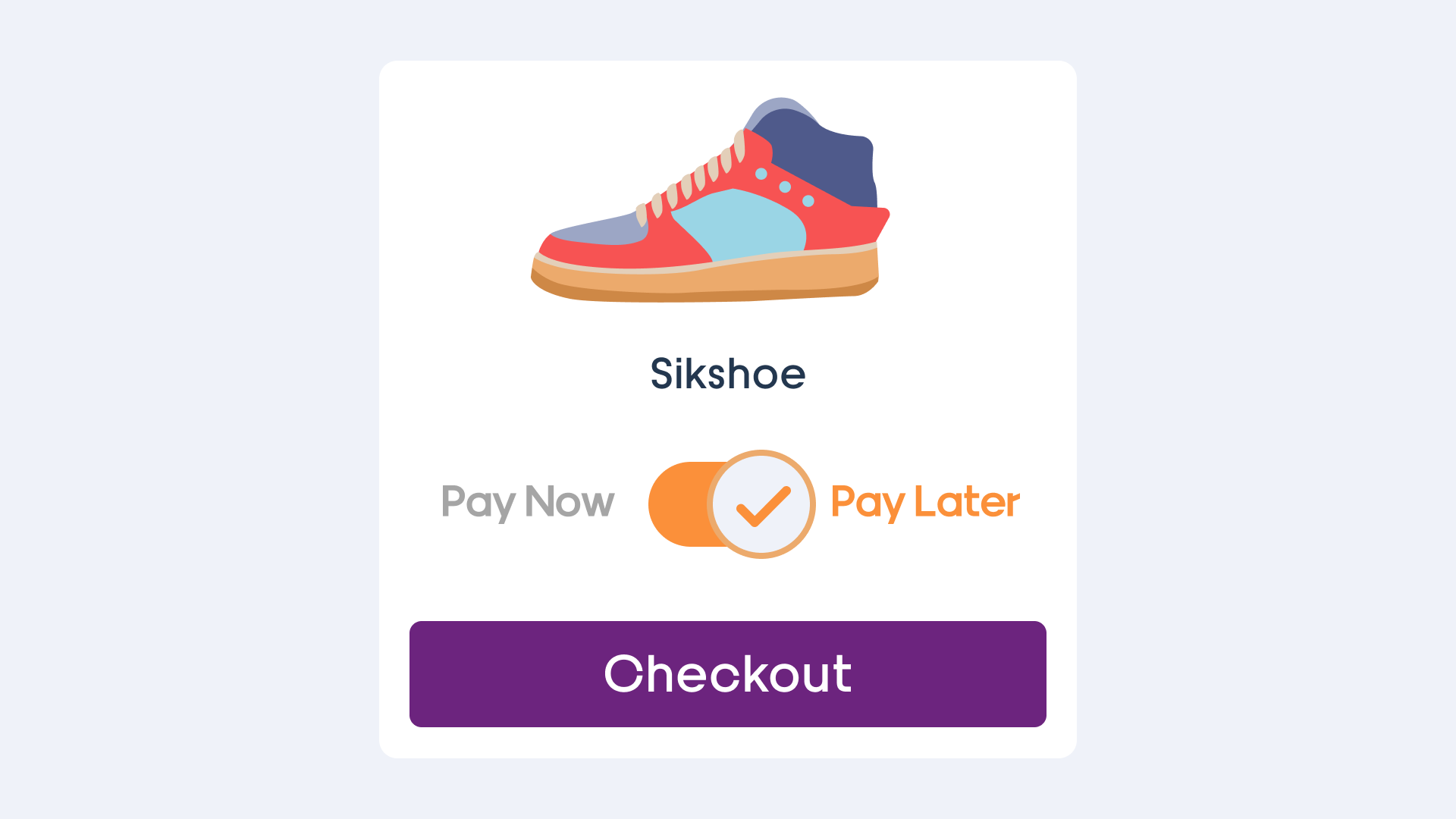

A native BNPL checkout

Imagine if a BNPL business decided to steal a march on its competitors by providing a checkout process that removed, as far as possible, friction from the checkout process. There would be no need for consumers to apply for a BNPL account in advance. That’s because they would automatically and immediately (in almost all cases) be approved for one while making their purchase. The consumer wouldn’t need to use an app or remember login details either. And they would never need to leave the website of the retailer they were buying from.

Could such a seamless checkout process result in less cart abandonment and maybe even larger basket sizes?

Real-world results

Actually, you don’t have to imagine. This is exactly what Limepay does with its unique checkout, which has already been adopted by some of the world’s largest brands, including Accor, EB Games and Puma.

Mia Hudson, the Director of Aussie online perfume retailer Feeling Sexy, was a Limepay early adopter. She appreciated the way conventional BNPLs appeared to increase online sales. But she soon “began to fear tossing customers in and out of our website” believing that this “reduced overall customer experience and damaged our conversion rates.”

The results after implementing Limepay?

“In our first four weeks with Limepay, we saw improved basket sizes by 12.5% and reduced checkout abandonment rate of 30%, growing our average daily revenues by over 18%,” Hudson reports.

Check it out for yourself

Plenty of other businesses have had similar experiences, but there’s no need to take theirs or Limepay’s word for it. If you’re interested in learning more about turbocharging your business’s BNPL checkout process, you can watch a video that explains Limepay’s near-frictionless checkout process here. If you then want to look into implementing a merchant-friendly BNPL in your own business after watching that video, you can arrange a demo here.