What Limepay data reveals about mid-market merchants

Data collected from your payment provider can highlight a more precise story of your customer behaviour and traits.

What Limepay data reveals about mid-market merchants

Data is a powerful business tool. And when the data is specific to defined customers, you can use it to make strategic decisions that lead to business success.

Business owners often look at trends and data collected across their industry and customers to guide decisions. But now, data collected from your payment provider can highlight a more precise story of your specific customer behaviour and traits.

A recent study revealed that Australian mid-sized businesses are experiencing strong growth and rising profits. Their ability to adjust, especially with the challenges of the past two years, has led to success within the mid-market sector1.

It’s a good time for these businesses to further define their high-value customers for sustainable growth.

At Limepay, the innovation behind our platform securely collects several data points for each transaction. By compiling these data points, we can draw insights that help guide the operational strategy of our mid-market merchants and provide information on trends.

When we look at the performance of our mid-market merchants over the past 12 months, we find that, with the Limepay checkout, purchase volumes have increased. Not only are there more transactions, but the average order value is up for a range of mid-market businesses. Across the board, the average order with a buy now, pay later (BNPL) payment plan was $467 versus $228 when customers paid in full immediately.2 That two-fold increase in the average order can significantly impact annual revenue predictions for merchants in that segment should they choose to focus their marketing efforts on BNPL options.

Across the mid-market business segment, customers choosing to create a payment plan instead of paying in full immediately take out an average of 1.4 payment plans per customer across all merchants. When we look deeper, data shows that rises to 1.6 payment plans per customer amongst high-value customers.

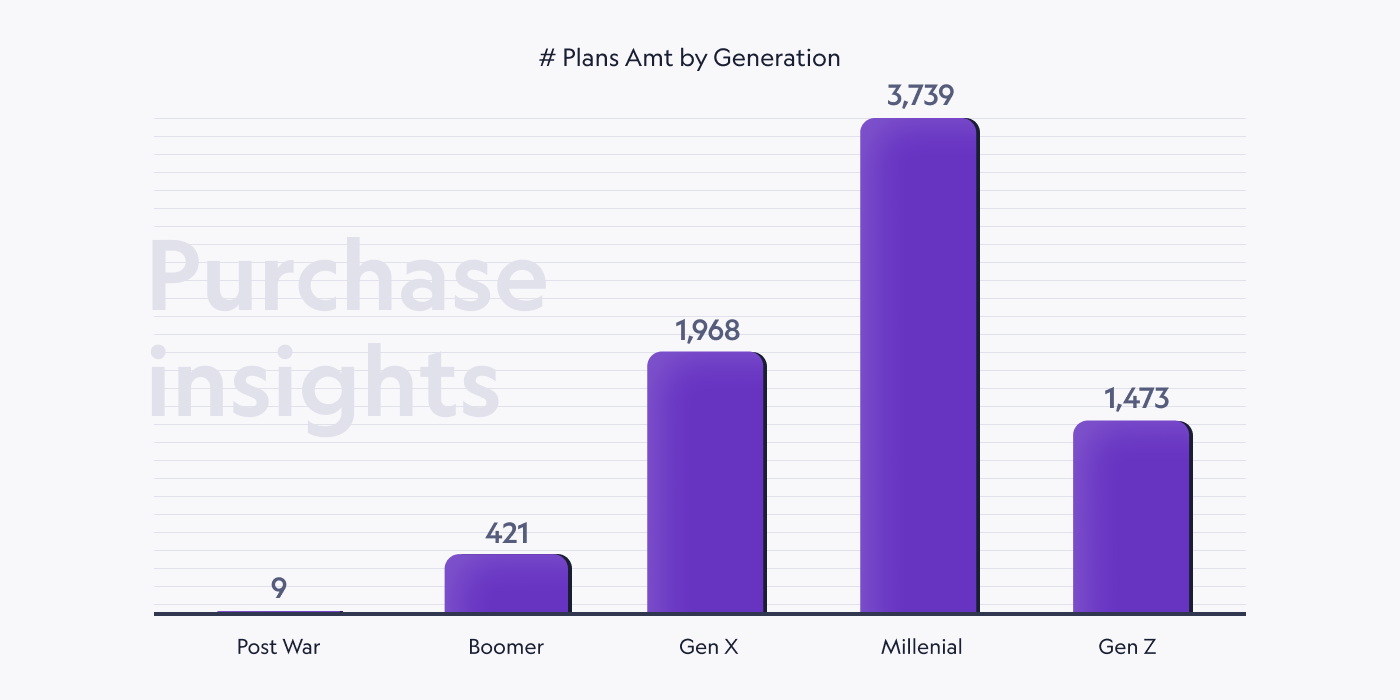

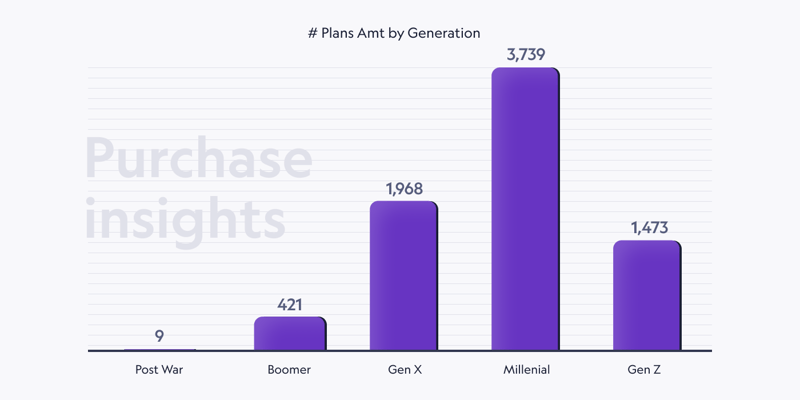

We can also look into how customers of different generations prefer to pay, and the results are surprising. It's not only Gen Z and Millennials increasing their online purchasing with BNPL payment plans. Boomers are close, trailing Gen Z by only $27 for the average basket size.

Armed with valuable customer insights, merchants can prioritise and focus on their high-value customers to drive increased revenue. High-value customers spend twice as much per order, on average, with more repeat purchases compared to the average customer.

Building your marketing plan

When you partner with Limepay, you’ll have easier access to deep customer insights to refine your marketing strategies.

With the help of our team, you can automatically segment your market by age, location and purchasing habits, with data compiled and analysed through the Limepay platform with each purchase. This automation makes it easy to evaluate the impact of your marketing campaigns from week to week or even by the hour.

Let your data drive efforts. When you know more about your customer and how they prefer to purchase, you can enhance their shopping experience and protect your valuable marketing budget while significantly increasing the impact of your campaigns.

Already accepting Limepay? Contact us for deep insights into the habits of your customers.

If you’d like more information, please contact our Marketing Team at support@limepay.com.au

2 Based on a selection of Limepay mid-market merchants over the 12 months to January 2022.