The Importance Of Working Capital

.png)

How to Digitise Payments Without An Ecommerce Site

Payment options like pay later and recurring payments are most common in retail and relatively easy to integrate within an eCommerce website.

But not all businesses have an online store or a website built with eCommerce options. Manufacturing, professional services and wholesalers haven’t had the same opportunities to accept digital payments, until now.

To make digital payments accessible beyond retail, Limepay has developed an all-in-one, complete API solution to create an equal payment environment.

Introducing Virtual Terminal

Virtual Terminal is part of a payment platform where a merchant can create an order for their customer and send the invoice or process the payment directly.

For example, an HR consultancy firm will meet with clients in person, by phone or online. Virtual Terminal makes it easier to invoice for services and complete transactions in the office for face-to-face clients or email an invoice link to remote clients.

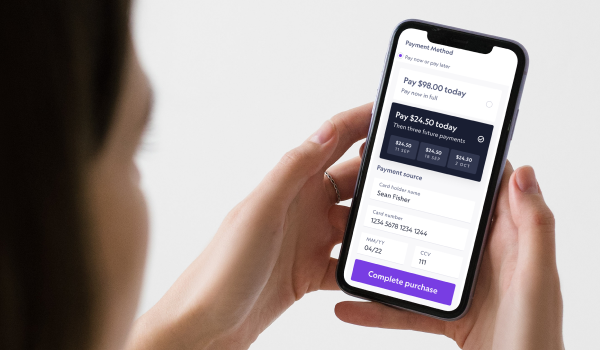

Where before clients had the choice of paying in full or by credit card, Virtual Terminal gives them the same flexibility they expect from their favourite online retail store. Clients can select to pay anywhere from 2 to 100 instalments.

Flexibility for clients leads to a pleasant customer journey, reduced payment friction and enhanced brand loyalty.

Speeding up payment

With Virtual Terminal, customers choose how they pay, and merchants get paid upfront. No more worrying about delayed payments.

The days of creating an invoice, saving it as a PDF and emailing the customer are waning. There’s room for too much error doing it this way, according to Kabbage, a subsidiary of American Express. “Ineffective invoicing techniques can hinder cashflow.”1

A recent survey analysing how manual processes affect accounts receivable found that firms in the advertising, technology, energy and health care sectors who relied on manual invoicing processes, spend 67% more time following up on late payments than firms who have an automated process.2

Virtual Terminal is an all-in-one solution that makes invoicing easier for merchants and eliminates common invoicing errors to get paid faster.

The Virtual Terminal difference

- No code required - start taking payments instantly

- Customisable fields to capture important customer information

- Tracking tools to keep merchants informed of payment status

- Flexible payment options for a seamless customer experience

- Helpful customer notifications by email or mobile messaging

-

3D Secure fraud protection and identity verification

The ability to customise fields gives merchants greater control. It’s easy to configure order information to capture details that support better reconciliation with external systems. And the notifications feature when payments are received increases transparency and supports internal business needs.

No eCommerce site needed

Virtual Terminal gives customers all the flexibility of the pay later options that they are used to when they shop online. They can split payments and decide the payment amounts for purchases like consulting fees, office equipment and business services.

The best part about Virtual Terminal is that it works for every business transaction scenario. You don’t need an eCommerce website with a plugin or integration to offer flexible payment options.

Ideal Virtual Terminal uses:

- Face-to-face transactions in the store

- Over the phone payment

- Via email or mobile phone link

Customers want (and expect) the convenience of paying how they want. And this is now possible for everyone with or without an eCommerce site. Limepay’s Virtual Terminal is changing the payment landscape for B2Bs and professional services. Flexible payment options are here.

To learn more about the features of Virtual Terminal, talk to our sales team today.

1 Do your invoicing methods affect cash flow Kabbage

2 The B2B Payments Innovation Readiness Playbook December 2020